Examples Cost Of Goods Sold . Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. Sales revenue minus cost of goods sold. what is cost of goods sold (cogs)? what is cost of goods sold? examples of costs generally considered cogs include: cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. This includes direct labor cost,. cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. Cogs is deducted from revenue to find gross. Cost of goods sold is the direct cost incurred in the production of any goods or services. This amount includes the cost of the materials and. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. cogs is often the second line item appearing on the income statement, coming right after sales revenue.

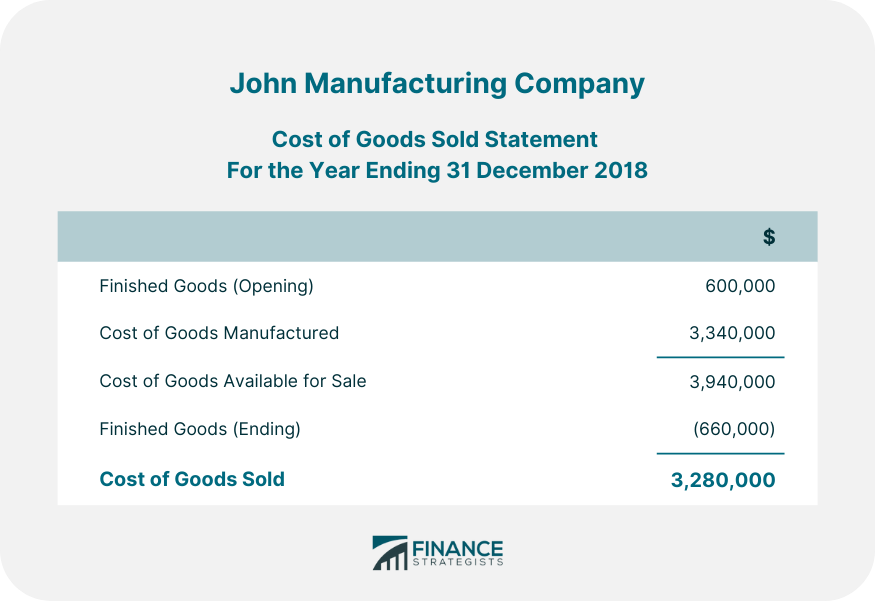

from www.financestrategists.com

examples of costs generally considered cogs include: cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. cogs is often the second line item appearing on the income statement, coming right after sales revenue. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. Sales revenue minus cost of goods sold. what is cost of goods sold (cogs)? This includes direct labor cost,. Cost of goods sold is the direct cost incurred in the production of any goods or services. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. what is cost of goods sold?

Cost of Goods Sold Statement Formula, Calculation, & Example

Examples Cost Of Goods Sold cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. Cost of goods sold is the direct cost incurred in the production of any goods or services. Sales revenue minus cost of goods sold. Cogs is deducted from revenue to find gross. what is cost of goods sold? cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. cogs is often the second line item appearing on the income statement, coming right after sales revenue. examples of costs generally considered cogs include: what is cost of goods sold (cogs)? cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. This includes direct labor cost,. This amount includes the cost of the materials and. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing.

From www.theledgerlabs.com

4 Methods & Examples to Calculate Cost of Goods Sold for Examples Cost Of Goods Sold Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. examples of costs generally considered cogs include: cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold is the direct cost incurred in the production of any goods or services.. Examples Cost Of Goods Sold.

From efinancemanagement.com

Cost of Goods Sold (COGS) All You Need To Know Examples Cost Of Goods Sold This amount includes the cost of the materials and. This includes direct labor cost,. cogs is often the second line item appearing on the income statement, coming right after sales revenue. Cogs is deducted from revenue to find gross. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. . Examples Cost Of Goods Sold.

From www.scribd.com

CGS Cost of Goods Statement Cost Of Goods Sold Cost Examples Cost Of Goods Sold examples of costs generally considered cogs include: Sales revenue minus cost of goods sold. what is cost of goods sold (cogs)? Cogs is deducted from revenue to find gross. cogs is often the second line item appearing on the income statement, coming right after sales revenue. what is cost of goods sold? cost of goods. Examples Cost Of Goods Sold.

From tutorstips.com

Cost of Goods Sold (COGS) its Formula and example Tutor's Tips Examples Cost Of Goods Sold Cost of goods sold is the direct cost incurred in the production of any goods or services. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. examples of costs generally considered cogs include:. Examples Cost Of Goods Sold.

From dloqfqqveco.blob.core.windows.net

Examples Of Cost Of Goods Sold at Erwin Garcia blog Examples Cost Of Goods Sold This amount includes the cost of the materials and. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. what is cost of goods sold? cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. Sales revenue minus cost of. Examples Cost Of Goods Sold.

From www.accountancyknowledge.com

Cost of Goods Sold Accountancy Knowledge Examples Cost Of Goods Sold cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. Sales revenue minus cost of goods sold. Cost of goods sold is the direct cost incurred in the production of any goods or services. This. Examples Cost Of Goods Sold.

From mint.intuit.com

Calculate Cost of Goods Sold StepbyStep Guide MintLife Blog Examples Cost Of Goods Sold This includes direct labor cost,. examples of costs generally considered cogs include: Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. This amount includes the cost of the materials and. what is cost of goods sold (cogs)? cost of goods sold (cogs) refers to the direct costs of producing the. Examples Cost Of Goods Sold.

From www.youtube.com

How to compute the cost of goods sold YouTube Examples Cost Of Goods Sold cogs is often the second line item appearing on the income statement, coming right after sales revenue. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. Cost of goods sold is the direct cost incurred in the production of any goods or services. cost of goods sold. Examples Cost Of Goods Sold.

From www.financestrategists.com

Cost of Goods Sold Statement Formula, Calculation, & Example Examples Cost Of Goods Sold This includes direct labor cost,. what is cost of goods sold (cogs)? Sales revenue minus cost of goods sold. Cost of goods sold is the direct cost incurred in the production of any goods or services. what is cost of goods sold? cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct. Examples Cost Of Goods Sold.

From www.investopedia.com

How operating expenses and cost of goods sold differ? Examples Cost Of Goods Sold Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. This includes direct labor cost,. what is cost of goods sold? what is cost of goods sold (cogs)? cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. Cogs is deducted from revenue. Examples Cost Of Goods Sold.

From www.accountancyknowledge.com

Cost of Goods Sold Examples CGS Format Solved Problems Examples Cost Of Goods Sold Cogs is deducted from revenue to find gross. cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers. Examples Cost Of Goods Sold.

From learn.financestrategists.com

Cost of Goods Sold (COGS) Formula, Examples, What Is Included Examples Cost Of Goods Sold Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. This includes direct labor cost,. cogs is often the second line item appearing on the income statement, coming right after sales revenue. Cogs is. Examples Cost Of Goods Sold.

From haipernews.com

How To Calculate Estimated Cost Of Goods Sold Haiper Examples Cost Of Goods Sold Cost of goods sold is the direct cost incurred in the production of any goods or services. examples of costs generally considered cogs include: cogs is often the second line item appearing on the income statement, coming right after sales revenue. what is cost of goods sold (cogs)? Sales revenue minus cost of goods sold. cost. Examples Cost Of Goods Sold.

From www.educba.com

Cost of Goods Sold Formula Calculator, Definition, Formula, Examples Examples Cost Of Goods Sold Cost of goods sold is the direct cost incurred in the production of any goods or services. cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. cogs is often the second line item appearing on the income statement, coming right after sales revenue. This amount includes the cost of. Examples Cost Of Goods Sold.

From www.slideserve.com

PPT Chapter 7 PowerPoint Presentation, free download ID6421395 Examples Cost Of Goods Sold what is cost of goods sold (cogs)? Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. Cogs is deducted from revenue to find gross. cost of goods sold (cogs) refers to. Examples Cost Of Goods Sold.

From learn.financestrategists.com

Cost of Goods Sold (COGS) Formula, Examples, What Is Included Examples Cost Of Goods Sold what is cost of goods sold (cogs)? what is cost of goods sold? Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct. cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. This amount includes the cost of the materials and. . Examples Cost Of Goods Sold.

From www.deskera.com

What Is Cost of Goods Sold (COGS)? Definition, Calculation, Examples Examples Cost Of Goods Sold cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. what is cost of goods sold? Cost of goods sold is the direct cost incurred in the production of any goods or services. Cost of goods sold (cogs), otherwise known as the “cost of sales”, refers to the direct.. Examples Cost Of Goods Sold.

From www.svtuition.org

How to Calculate Budgeted Cost of Goods Sold Accounting Education Examples Cost Of Goods Sold cost of goods sold (cogs) is the direct cost of a product to a distributor, manufacturer, or retailer. cost of goods sold, often abbreviated cogs, is a managerial calculation that measures the direct costs incurred in producing. cost of goods sold (cogs) refers to the direct costs of producing the goods sold by a company. what. Examples Cost Of Goods Sold.